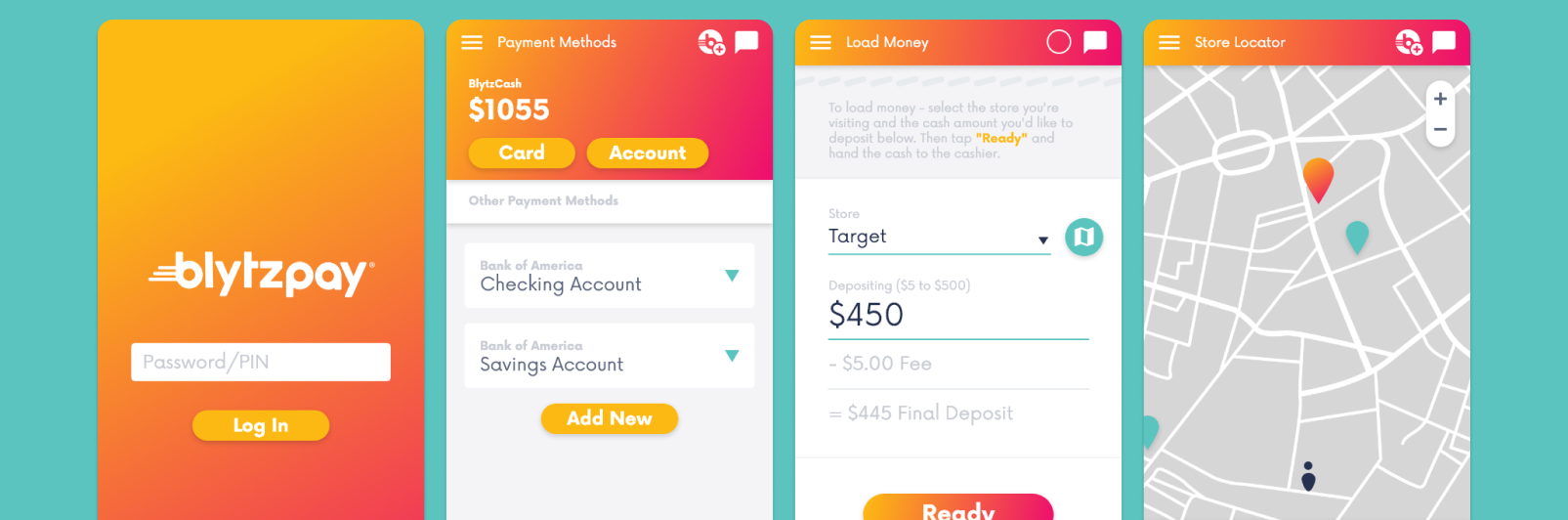

Diagram of several key parts of invoicing. Red and yellow boxes indicate difficult or risky steps in the process.

A small section of the invoicing flow. I devoted a lot of time to defining terms.

Two sets of icons, both used for adding / removing line items from an invoice in different tabs.

Invoice controls - note that there is no 'save' button. 'Load' here refers to loading items into an invoice, instead of loading a previous invoice.

A feature roadmap shows the relative simplicity of developing and adopting the 'Integrate with Netsuite' solution.

A feature roadmap shows the relative difficulty of developing and adopting the 'Fix our Tools' solution.

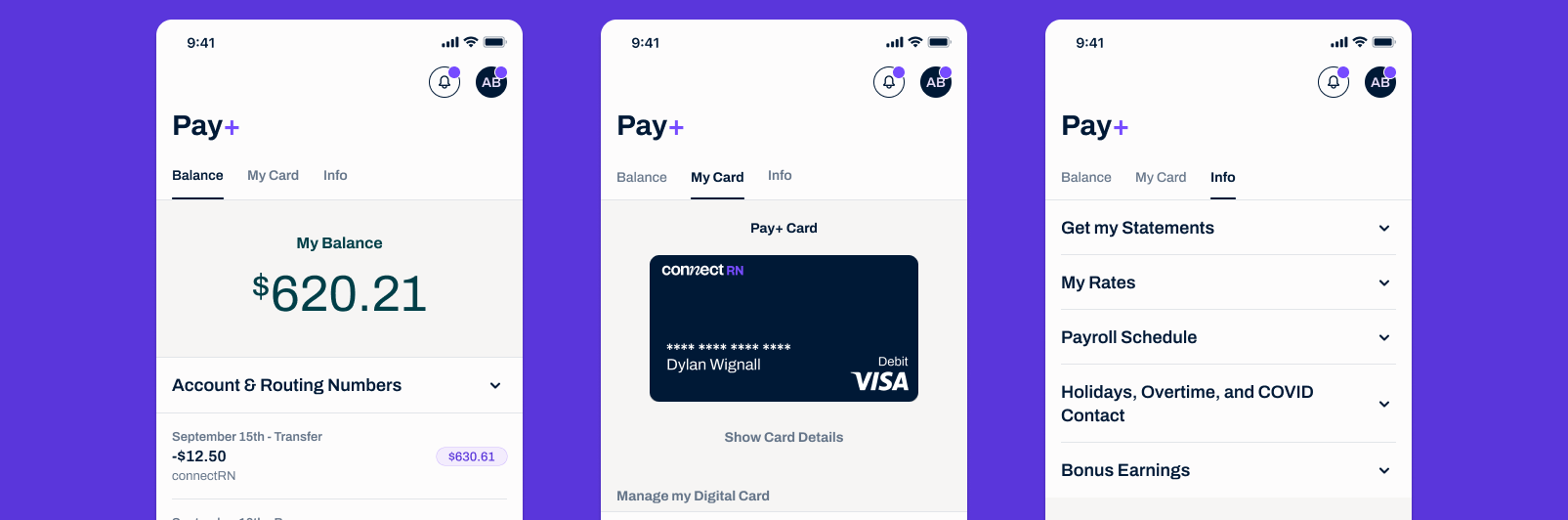

An upgraded invoice screen with improved design system usage and save/load functions.

A new feature - adding credits to invoice line items in response to client complaints.

Example slide from a funding meeting, explaining a new process for saving invoices.

An early draft of the "Integrate with Netsuite" solution.

An ownership diagram lays out which platform will own which data points.

The final, 'bare bones' implementation of the NetSuite Connection

An upgraded "Connection Wizard" that allows the user to rapidly sync the ConnectRN and NetSuite databases.

A user reviews all conflicts between the two databases, with options on how to align them together.